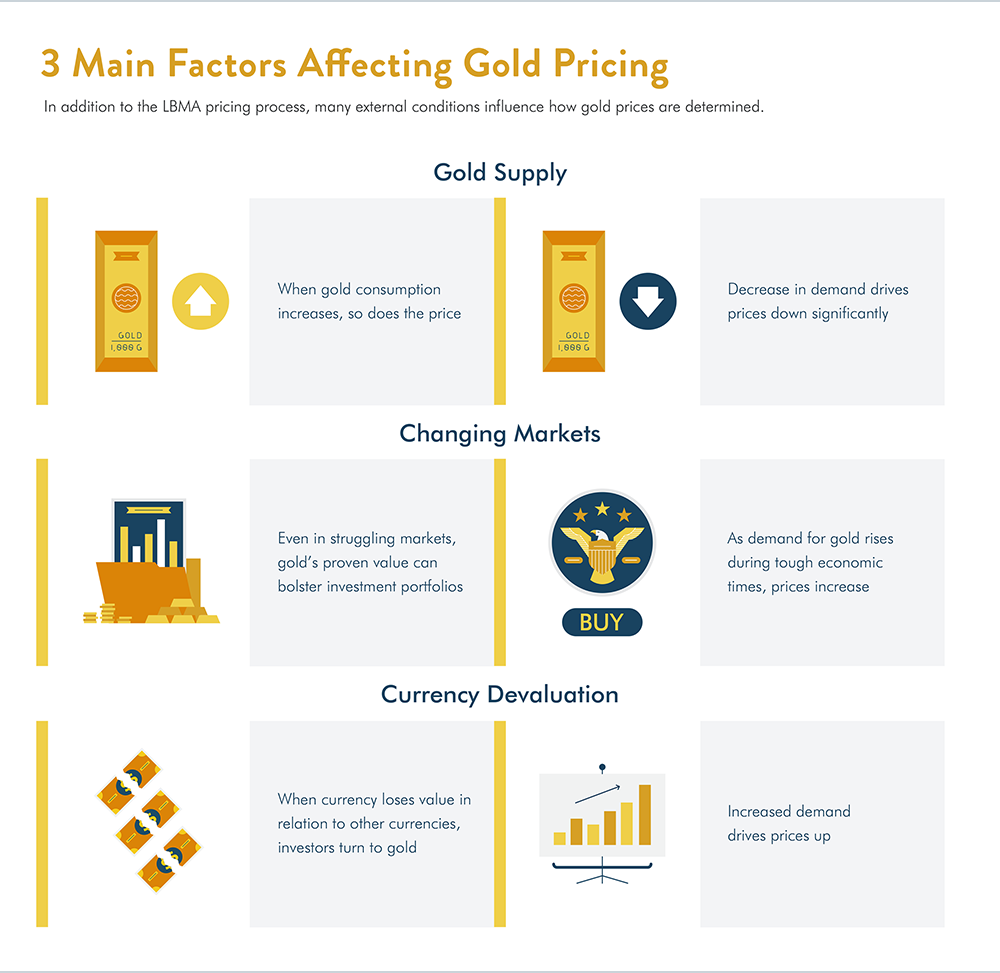

Demand and supply play a major role in pricing of gold. When there is a rise in demand for gold the price increases and vice versa.

Gold As An Investment Wikipedia

Gold As An Investment Wikipedia

Gold is one commodity that is continuously in demand.

What affects gold prices. Gold and inflation When inflation rises the value of currency goes down and therefore people tend to hold money in the form of gold. Lets look at some factors below. Supply demand and investor behavior are key drivers of gold prices.

2 Gold and silver prices are correlated to global money supply and inflation. Factors That Affect Gold Pricing 1. There are various factors affecting the price of gold.

When inflation rises the currency values go down. As gold prices react to inflation Indians prefer to invest in gold. There is a positive link between gold prices and economic growth via demand for gold in the form of jewellery technology and long-term savings.

Higher supply of US. Low gold prices mean the economy is healthy making stocks bonds or real estate more profitable investments. A common reason cited for holding gold is as a hedge against inflation and.

Our model provides a quantitative attribution of the key factors that have influenced golds performance over a given period. Gold and interest rates. Gold can sometimes be useful in technology because its an.

Gold prices reveal the true state of US. The competition between OPEC supply and US shale oil further reduced oil prices. 5 Factors You Didnt Know That Truly Influence Gold Prices Investing 101 ANIMATION - YouTube.

This means the metals price goes up when there is inflation in the economy and it goes down when there is deflation in the economy. Gold is often used to hedge inflation because unlike paper money its supply doesnt change much year to year. Gold tends to move in the opposite direction of real yields which are bond yields adjusted for inflation.

Investors buy gold as protection from either an economic crisis or inflation. Therefore in times when inflation remains high over a longer period gold becomes a tool to hedge against inflationary conditions. For millennia cultures around the world have used gold as a form of currency.

Golds Status as a Store of Value. In the Forex market gold is a form of currency. Because gold prices tend to rise when people lack confidence in governments or financial markets it.

The internationally accepted code for gold is XAU. When gold prices are high that signals the economy is not healthy. Fundamentally the answer to what affects the price of gold is the same as for every other market.

Therefore gold prices can be affected by the basic theory of supply and demand. Gold Supply Even though gold has been produced for thousands of years the vast majority of the gold. 5 Factors That Affect Gold Prices 1.

Hovering the mouse cursor over the chart generates a windowed summary of the selected. Unlike most other metals demand for. The chart below shows the linear correlation between EuroUSD and gold price during 2012.

2 risk and uncertainty. Demand for Gold The primary factor affecting the gold price is demand for gold. The monetary expansion QE1 and QE2 might have been among the key factors in pulling the price of gold up.

Cheaper commodity and oil prices negatively affected the gold price. Oil and slower global growth weakened oil prices and consequently gold prices. This is particularly true in developing economies where gold is often used as a luxury item and a means to preserve wealth.

Yet the supply and demand balance for gold a market which dates back to the dawn of record-keeping itself is itself largely driven. Gold prices are determined by the interaction of drivers from four key categories. The price of gold will then shoot up as a result of high demand from customers.

How These 10 Factors Regularly Influence Gold Prices 1. This holds true for both international inflation as well as that which occurs in India. As demand for consumer goods such as jewelry and electronics increases the cost of gold can rise.

Thus people tend to hold money in the form of gold. The particularity of gold is that it can only be traded against United States dollars USD. As a result when the inflation is high the demand for gold increases and vice versa.

The FOMC monetary decisions. This pushes gold prices higher in the inflationary period.

Why Gold Price Is Increasing Factors That Influence Gold Prices

Why Gold Price Is Increasing Factors That Influence Gold Prices

What Affects The Price Of Gold Gold Eagle News

What Affects The Price Of Gold Gold Eagle News

The Analysis Of Factors Affecting Global Gold Price Sciencedirect

The Analysis Of Factors Affecting Global Gold Price Sciencedirect

Know What Affects Value Demand Of Gold In India My Gold Guide

Know What Affects Value Demand Of Gold In India My Gold Guide

Gold Price Factors That Affect Gold Price

Gold Price Factors That Affect Gold Price

All About The Price Of Gold In Malaysia And What Affects It

All About The Price Of Gold In Malaysia And What Affects It

Why Gold Prices Go Up And Down Five Charts

Why Gold Prices Go Up And Down Five Charts

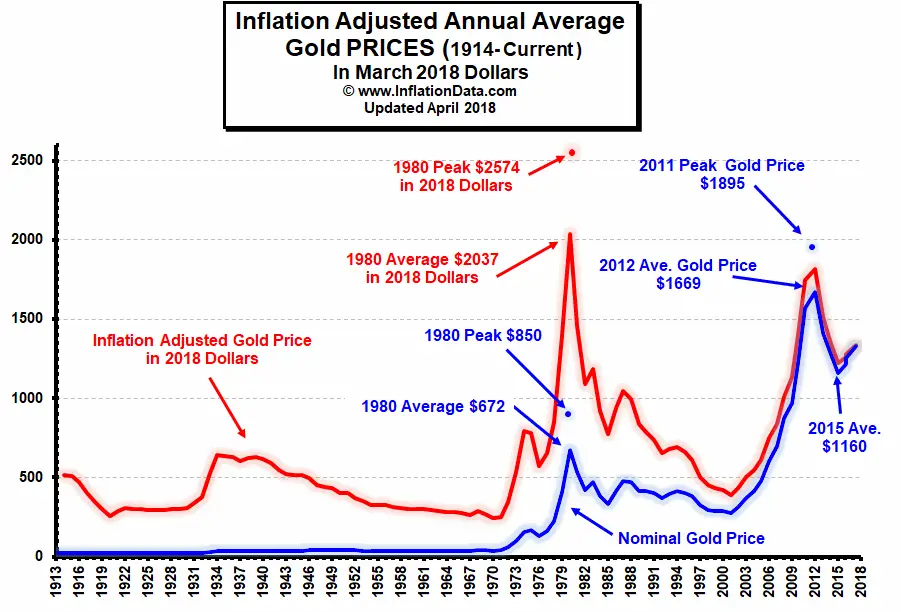

How Does Inflation Affect The Price Of Gold

How Does Inflation Affect The Price Of Gold

What Affects The Gold Price In India Times Of India

What Affects The Gold Price In India Times Of India

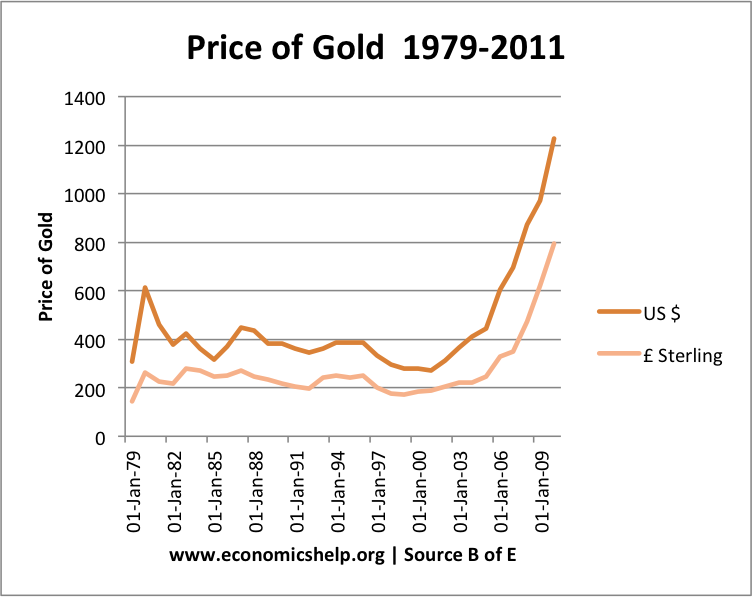

Factors Affecting The Price Of Gold Economics Help

Factors Affecting The Price Of Gold Economics Help

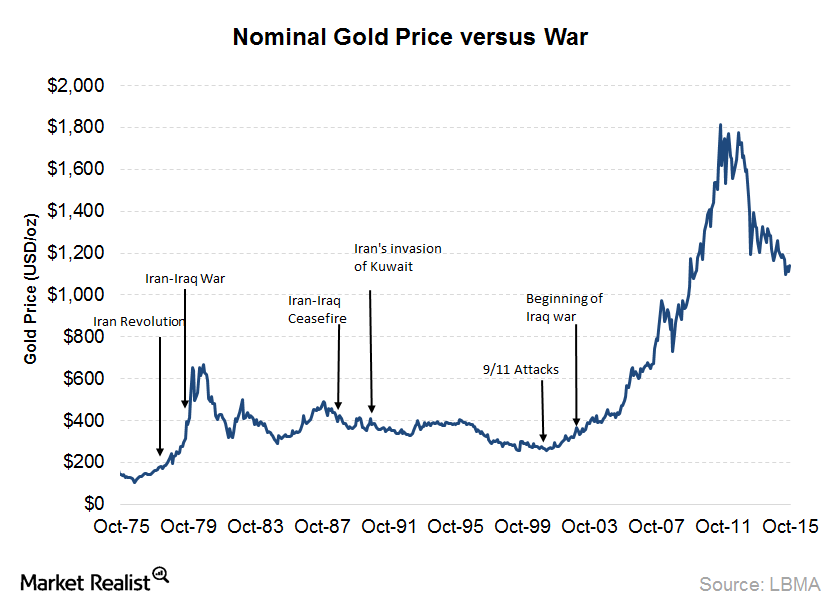

How The Threat Of War Affects Gold Prices

How The Threat Of War Affects Gold Prices

Quantitative Easing 3 And Its Effects On Gold Prices

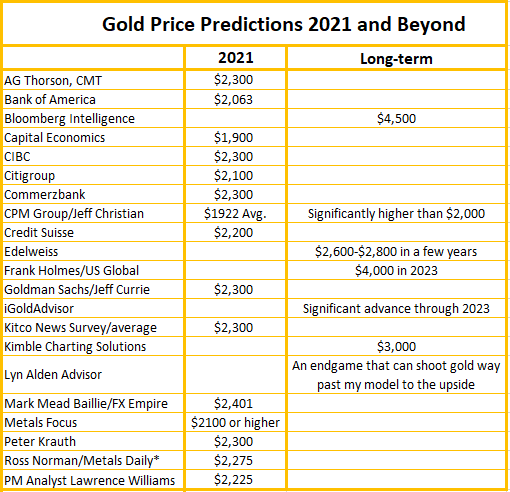

2021 Gold Price Prediction Trends 5 Year Forecast

2021 Gold Price Prediction Trends 5 Year Forecast

Understanding How Gold Prices Are Determined Scottsdale Bullion Coin

Understanding How Gold Prices Are Determined Scottsdale Bullion Coin

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.