Call 416-783-1027 or click on the next button to request a demo Learn More. Pharma has historically experienced long delays in payment for sales to this entity.

Net revenues equal its revenues from sales at a drugs net price ie the actual revenues received and reported by the manufacturer after rebates discounts and other reductions.

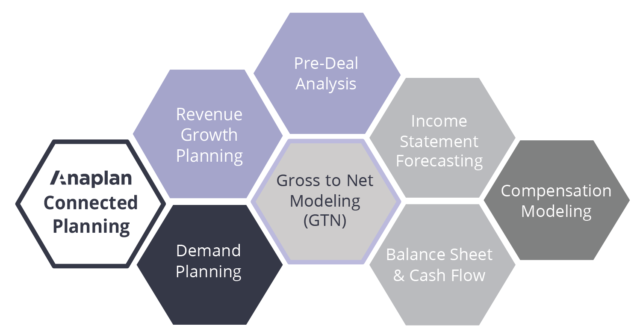

Gross to net pharma. The components of gross-to-net adjustments to revenue for pharmaceutical and biotech companies including returns chargebacks rebates and other adjustments. Pharma Gross-to-Net GTN Channel Forecasting is an accelerator solution within Keyrus Connected Pharma Commercial Planning suite of accelerators. Data is scattered everywhere incomplete and not at desired levels of detail making it virtually impossible to do contract-level rolling forecasts of sales deductions that can be easily updated as new information becomes.

Apply to Senior Contract Analyst Director of Strategy Compounder and more. Pharma has sold prescription drugs to this entity for the last five years and continues to sell prescription drugs at its normal market price. Educational workshops webinars are tailored to enhance knowledge of individuals specializing in Accounting Financial.

The general principles of the 5-Step Model for recognition of revenue under ASC Topic 606. A manufacturers gross revenues equal its revenues from sales at a drugs WAC list price. It represents a major part of the value chain and typically lies between 15 and 20 of the gross sales.

GTNPharma provides unique opportunities to learn about key pharmaceutical finance concepts with an emphasis on practical applications and best practice with gross-to-net educational training. The sum of these two components is often called Gross to Net GTN as it is the difference between the Gross and Net sales. Gross-to-Net Profitability Analysis tells if the company is making or losing money on any business segments.

In 2017 the gross-to-net bubblethe ever-growing pile of money between a manufacturers list price for a drug and the net price after rebates and other reductionshit a new high. This statistic shows the total value of pharmaceutical manufacturers gross-to-net reductions on medications in the United States from 2012 to. Pharma sells prescription drugs to a government entity for 5 million.

Based on new data from IQVIA manufacturers of brand-name drugs in 2017 reduced list price revenues by an astonishing 153 billion. IntegriChain Gross-to-Net Expert Jen Sharpe to Speak at Informas BioPharma CFO Digital Week Philadelphia PA May 6 2021 IntegriChain delivering Life Sciences only comprehensive data and business process platform for market access today announced that Jen Sharpe a Gross-to-Net GTN leader at the company will present at Informas upcoming BioPharma CFO Digital Week. For the top ten pharmaceutical companies the GTN amounts to over 50bn.

Our client-focused Tableau Online platform provides standardized analyses of net pricing trends by industry company and therapeutic area and enables clients to perform analyses customized to their specific requirements. Gross-to-net forecasting and accruals are a significant challenge facing many pharmaceutical companies today. The dataset includes gross and net prices for the majority of active US brand name prescription drugs approximately 1000 products across more than 100 companies.

In most organizations today Gross-To-Net GTN is a highly manual process which is further encumbered by disintegration of processes and data among business groups. Gross-to-Net Revenue Adjustments for the Pharmaceutical Industry This course will be an overview of. Gross to Net Planning Two Labs Gross to Net Solutions team partners with pharma manufacturers to determine accurate expenses and revenue so they can create.

Pharmaceutical manufacturers find it difficult to forecast their net revenue because product pricing adjustments discounts to their gross revenue are highly complex vary greatly across market segments and customers and contain high-data volumes to process. Factors such as product portfolio changes pricing and contracting strategy changes and uncertainty with downstream data make it difficult for manufacturers to manage their gross-to-net process.