2020 Edition - YouTube. On the stocks profile page or chart click on the trade button.

How To Buy Stock On Fidelity Youtube

How To Buy Stock On Fidelity Youtube

Good Money Yall In this video I show you how to buy and sell stock on Fidelity RESOURCES MENTIONED IN THIS VIDEO You can follow me on on IG _rekad.

How to buy stock through fidelity. Over the short term the stock. A flat fee of just 10 per trade when buying or selling shares online. Besides its proposed bitcoin fund.

Make sure that the mutual fund is the right investment and not an ETF. Learn more on how to sell shares in your Fidelity Account. As an example suppose you want to buy a hypothetical Japanese stockticker XYZwhich closed on the previous trading day at 1250 yen.

All international stocks must be sold on the same exchange where you originally purchased the shares. Sell orders are subject to an activity assessment fee from 001 to 003 per 1000 of principal. Watch how to trade Learn trading definitions How to get cash from your Fidelity Account Learn how to set up Electronic Funds Transfer EFT instructions on your Fidelity Account for transferring cash out.

To place a trade over the phone costs 5 and trading with a living broker is a somewhat pricey 2995. Picking a Mutual Fund. 4 benefits of financial advice.

Watch EFT video Learn how to set up EFT Access your account online. Equity trades exchange-traded funds ETFs and options 065 per contract fee in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. While Fidelity offers different cryptocurrency-related services to hedge funds and trading firms for regular investors theres not a lot of options out there.

For example if you purchase 100 shares of Nestlé on the French exchange and you decide to sell those shares. Buying and Selling Stock To Transfer Cash Back To Your Account Investing - YouTube. There is a 2500 opening deposit requirement.

How To Buy A Mutual Fund At Fidelity With Screenshots Step 1. 000 commission applies to online US. If playback doesnt begin shortly try.

There is an Options Regulatory Fee from 003 to 005 per contract which applies to both option buy and. A stock order at Fidelity can be placed on the brokers website mobile app Apple Watch or Active Trader Pro the firms advanced trading platform. But keep in mind that there may be a lot of ups and downs and there is a generally higher risk of loss in stocks than in investments like bonds.

Stocks have historically provided higher returns than less volatile asset classes and those higher potential returns may be necessary in order for you to meet your goals. In Time in Force Day displays thats the only available choice. If you choose limit enter the limit price.

Select an order type you can only choose market or limit. As a result your limit price for XYZ. Sometimes a mutual fund.

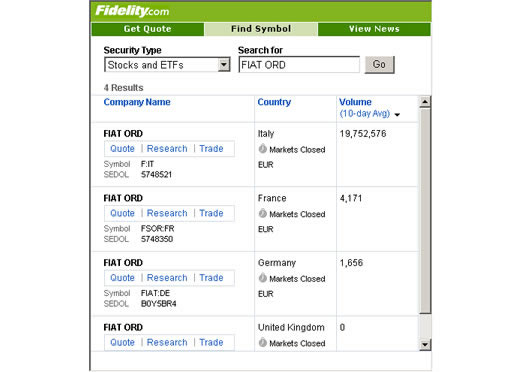

As shown in the table below the daily price limit for a stock with this base price is 300 yen. How to Buy a Stock on Fidelity. However sole proprietors and business partners can open a Fidelity self-directed 401k plan and manage it themselves.

Beginners tutorial on how to set up a brokerage account and place your first stock mutual fund or ETF trade using Fidelity or most other brokerages. They then have access to trading individual stocks mutual funds commodities options and other investment choices. In all cases the basic steps and order types are the same.

This means that the maximum potential upside or downside for XYZ on the day is 300 yen for a maximum trading range of 9501550 yen. Plans maintained with previous employers can be transferred to Fidelity. Buying and Selling Stock To Transfer Cash Back To Your.

On the trade ticket select Action then Buy and enter the quantity. Fidelitys charge for stocks and ETFs trading is 0. I am a big advocate for index funds because these funds hold hundreds or thousands of.

You can also buy and sell shares over the phone for 30 per trade. A lower fee of 150 when buying shares as part of a regular savings plan or for dividend re-investments. Fidelity Investments provides over 10000 mutual funds many of which come with no load and no transaction fee when held more than 2 months.