Note we do accept applicants with insufficient credit history to produce a FICO score. If you find discrepancies with your credit score or.

With a 35 annual fee.

Tcf bank credit score. By making on-time monthly loan payments you will have the opportunity to establish credit or potentially improve your credit score. No bankruptcies on any of. Consumers and clearly demonstrates to lenders that you are an exceptional borrower.

800 or Higher Exceptional. You can apply for a TCF Bank credit card online. These borrowing options are very convenient when you need extra cash to cover unexpected expenses make home renovation buying a.

If youre looking to increase your credit score choose a different secure card that specifically advertises its reporting to help you get your credit score back on track. Your score is above the average score of US. TCF Bank is a Minnesota-based national bank holding company with 375 branches in seven states.

Youre leaving our site. Account Features Benefits. 740 to 799 Very Good.

Borrowers must also meet the following criteria. These TCF Terms and Conditions Terms is made and entered into between you and TCF National Bank TCF governs your use of the website operated by Upstart Network Inc. You have three cards to choose from.

However TCF Bank claims this is a card to help build and rebuild your credit But its not easy to find whether it reports your responsible use to any of the three major credit bureaus. Take the myFICO Fitness Challenge. This APR will vary with the market based on the Prime Rate.

TCF Bank Follow us for financial tips and motivation to help your best self shine. Learn more about Credit Scores and Reports in the free TCF Financial Fitness Program developed by Everfi. Consumers and demonstrates to.

Convenience for all your everyday purchases. The TCF Bank consumer card program offers several different credit card options so consumers can find a card that best suits their needs including one for Maximum Rewards. Best for rewards without an annual fee.

TCF Bank Visa Credit Card. Small business admin SBA loans. Message 2 of 10.

When your loan is completely paid off the CD is released to you. TCF is providing this link as a convenience and does not endorse and is not responsible for the products services links content privacy or security policies or system availability of this website. Borrowers on TCF Bank must have a minimum FICO or Vantage score of 660 as reported by a consumer reporting agency.

I called TCF Bank the next day of me noticing the fraud. All loans are subject to credit approval NMLS Registry Listing. As a Preferred SBA Lender TCF National Bank works with the Small Business Administration to offer a variety of loan programs such as the Express SBA 7a and 504 loans designed to help achieve the goals of small businesses in our communities.

Explore all that your credit card account has to offer. TCF Bank has a limited network of branches and ATMs and it may end up costing you. Your cash deposit plus the loan proceeds will be used to open a TCF certificate of deposit CD account on your behalf and held as collateral.

I had someone fraudulently access 400 on my debit card. TCFs links to social media sites are also being provided as a convenience. 25 statement credit when you make a purchase within the first 3 billing cycles 3 after the account is opened.

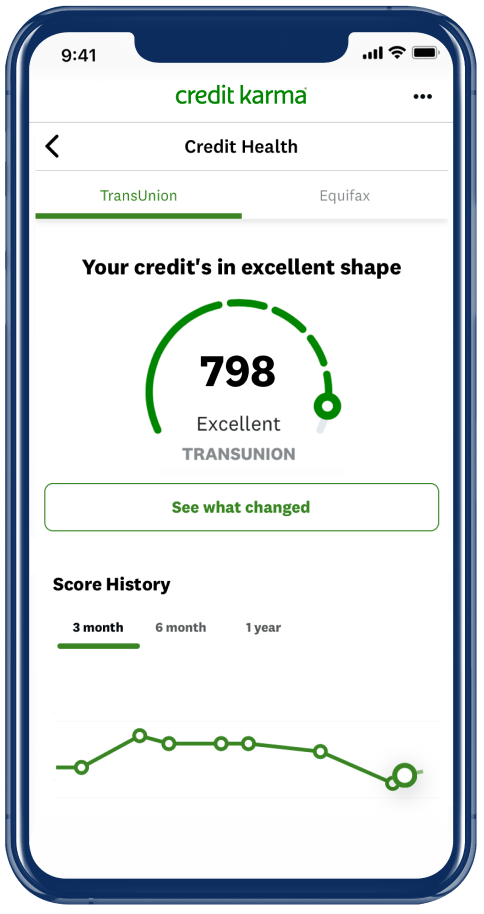

TCF Terms and Conditions. Credit scores can have a big impact on your financial life. TCF Bank financing options are easily accessible if you have good to excellent credit score and regular monthly income.

You also agree that TCF National Bank may contact you at the email address you provide. Maximum Rewards Visa Card. Log In to Your Account.

Your mobile carriers charges may apply. Upstart to i request loan offers and ii apply for and if approved obtain a loan from TCF Website ServicesAll loans are installment loans made by TCF a national banking. The consumer cards offer a variety of benefits including a low introductory.

Your score is well above the average score of US. Dont expect to grow your savings at this bank. Chemical FInancial Group has acquired several banks of late and tcf bank is working through the process now with closing in the third or fourth quarter 2019.

You can revoke your agreement to receive marketing emails at any time. Enjoy the convenience and many benefits your account has to offer. 0 introductory Annual Percentage Rate APR 1 for the first 12 billing cycles after the account is opened on balance transfers After the introductory APR your APR will be 1399 to 2299 based on your creditworthiness.

Keep in mind a credit card application will result in a hard inquiry affecting your credit score for a.