Due to market volatility the Funds current performance may be lower or higher than quoted. Due to market volatility the Funds current.

Socially Responsible Investing Great For Your Soul But Not Your Wallet Seeking Alpha

Socially Responsible Investing Great For Your Soul But Not Your Wallet Seeking Alpha

Better yet manager Joe.

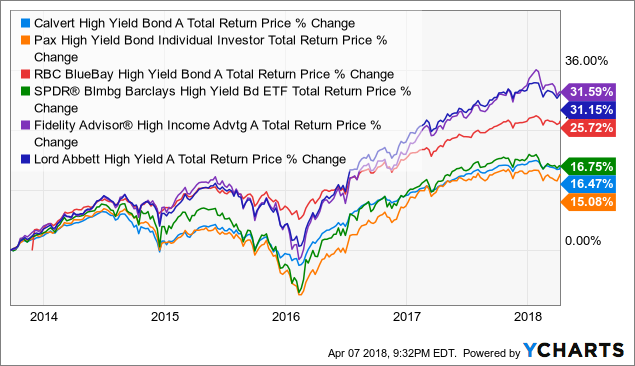

Calvert funds performance. Quote Fund Analysis Performance Risk Price Portfolio People Parent All Funds by Classification. Demonstrate poor environmental performance or compliance records contribute significantly to local or global environmental problems or include risks related to the operation of nuclear power facilities. Calvert Growth Allocation Fund.

Calvert Equity Fund CSIEX a champion of ESG investing has been among the best mutual funds in terms of performance. CLDIX Calvert Core Bond Fund formerly Calvert Long-Term Income Fund I CVMIX Calvert Emerging Markets Equity Fund I. Fund Performance The fund has returned 6527 percent over the past year 1366 percent over the past three years 1465 percent over the past five years and 1172 percent over the past decade.

The Funds past performance is no guarantee of future results. Analyst rating as of Oct 20 2020. Calvert Equity I CEYIX Morningstar Analyst Rating Analyst rating as of Oct 20 2020.

28 rows Standardized Performance. 29 rows Calvert Performance. Calvert Income Fund I CINCX.

Performance The fund has returned 1701 percent over the past year 1625 percent over the past three years 1745 percent over the past five years and 1301 percent over the past decade. The Refinitiv Lipper Fund Awards granted annually highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. Investment return and principal value of Fund shares will fluctuate so that shares when redeemed may be worth more or less than their original cost.

Fund Performance The fund has returned 1412 percent over the past year 611 percent over the past three years 509 percent over the past five years and 407 percent over the past decade. Small fund family groups will need to have at least three equity three bond and three mixed-asset portfolios. The application of the Calvert Principles generally precludes investments in issuers that.

Performance is for the stated time period only. Principal Risks Past Performance 2 CSIF Balanced 7 CSIF Equity 11 Calvert Social Index Fund 14 CSIF Enhanced Equity 19 Calvert Large Cap Growth 24 Calvert Capital Accumulation 29 Calvert World Values International Equity 34 Calvert New Vision Small Cap 38 Calvert Small Cap Value 42 Calvert Mid Cap Value 47 CSIF Bond 54 CSIF Money Market. The fund has returned 4719 percent over the past year 2107 percent over the past three years 1852 percent over the past five years and 1404 percent over the past decade.

Investment return and principal value will fluctuate so that shares when redeemed may be worth more or less than their original cost. Year to Date YTD returns are historical and are. Performance is for the stated time period only.

Due to market volatility the Funds current. Calvert Equity A CSIEX. Calvert Income Fund I CINCX.

Quote Fund Analysis Performance Risk Price Portfolio People Parent. Its this extensive experience that allows us to better understand how the pressing challenges facing society today underpin a complex range of both risks and opportunities for the companies in which we invest. Calvert has been at the forefront of ESG investing for decades focusing on matters related to the Environment Society and corporate Governance.

1As of November 30 2020. 29 rows Performance is for the stated time period only.