Theres no fee if you want to transfer out of your Vanguard account. Stocks Fidelity mutual funds and many exchange-traded funds.

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

To trade mutual funds a 2500 minimum deposit is needed and for margin trading a 5000 minimum deposit is required.

Fidelity brokerage account fees. About Our Commissions and Fees. Fidelity Fees and Account Minimums The Fidelity Account has no minimum balance requirement and comes with zero monthly and annual account fees. The accounts will let teens buy and sell US.

Sell orders are subject to an activity assessment fee from 001 to 003 per 1000 of principal. Equity trades exchange-traded funds ETFs and options. However the fee is easily waived by signing up for e-delivery service or if you have 10000 already invested.

Fidelitys options fees are low at 065 per contract. The Fidelity BrokerageLink account is highly flexible and our cost structure is flexible as well. There is a 10 fee for choosing this method but funds.

There may also be commissions interest charges and. Similar to how it works for adults the service wont charge account fees or. For a regular brokerage account Fidelity requires a minimum opening deposit of 2500.

000 commission applies to online US. Placing the trade over the phone is 5 and placing the trade with a living breathing broker is a somewhat pricey 3295. Laszlo Hanyecz spent 38 billion on.

Fidelity to Offer No-Fee Brokerage Accounts to Teenagers Brittney Myers 3 days ago. About Our Commissions and Fees. There is no setup charge nor is there an annual fee.

Equity trades exchange-traded funds ETFs and options 065 per contract fee in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. There is an Options Regulatory Fee from 003 to 005 per contract which applies to both option buy and sell transactions. Our use of à la carte pricing for many features helps to ensure that you only pay for the features you use.

If you choose to invest in mutual funds underlying fund expenses still apply. The firms charge for trading stocks and regular ETFs is 0. Ad-supported streaming steals the show at TV upfronts.

It simplifies its efforts with commission-free pricing and a very easy-to-use platform. The broker does not assess any fees for inactivity and there is no minimum balance requirement. Fidelity requires no minimum deposit to open an account.

Fidelity has no account service or transfer out fee. How much do you have to invest to open an account. Vanguard carries a 20 annual account service fee for each brokerage and retirement account.

The online trading fees of Fidelity Brokerage Account are below the average 890 for online brokerages. IRA Fees at Fidelity An IRA at Fidelity comes with no special fees. Fidelity Brokerage Account does not have a minimum amount to start an account.

Fidelity Transaction Fees - These are fees charged by Fidelity. No account minimums and no account fees apply to retail brokerage accounts only. 8 Zeilen Fidelity Annual Fee.

Funds on the Fidelity BrokerageLink platform can be one of the three following categories. Fidelity Wire Transfer Withdrawal Fidelity also offers a wire service. However there are other fees to consider.

But for a retirement account there is no minimum required. Broker assisted trades cost 3295. Account Service Fee and Transfer Out Fees.

Fidelity offers industry-leading value with no minimums to open a retail brokerage account and no account fees. FIDELITY BROKERAGELINK COMMISSION SCHEDULE. Fidelity does not charge annual fee for regular brokerage individual.

Online stock and ETF trades are 0. Review the funds prospectus for details. Fidelity full and partial account.

3 Zeilen 000 commission applies to online US. There are no fees to open a Fidelity BrokerageLink account. Brokerage Commission and Fee Schedule FEES AND COMPENSATION Fidelity brokerage accounts are highly flexible and our cost structure is flexible as well.

Account minimums may apply to certain account types eg managed accounts andor the purchase of some Fidelity mutual funds that have a minimum investment requirement. Minimum to open most Fidelity accounts is somewhat high 2500. An external account must first be linked to your Fidelity securities account before a transfer can be initiated.

Our use of à la carte pricing for many features helps to ensure that you only pay for the features you use. Fidelity has low non-trading fees and low trading fees. The great part is that it also has zero commission fees for stock trading.

If you have more than one Fidelity account such as a trading account and a Cash Management Account each account must have separate connections.

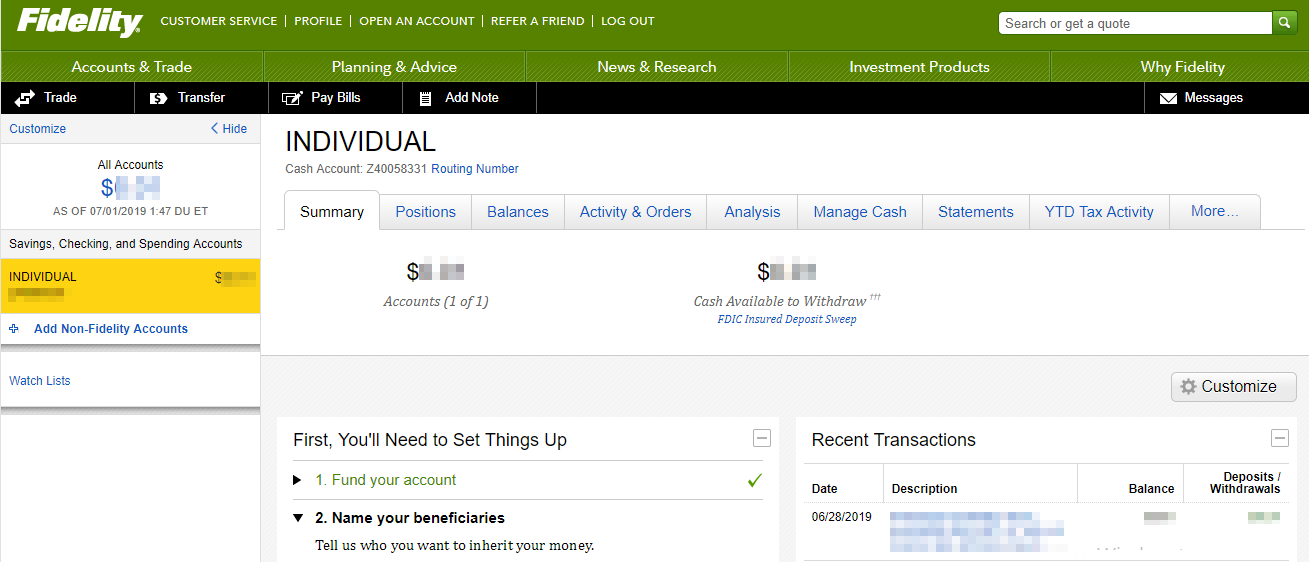

:max_bytes(150000):strip_icc()/ScreenShot2020-03-25at4.04.20PM-10218ff3c7314aafac9a19264e9b01c7.png)