Other times the opposite might be true. If I created a score range from 1000-2000 even the worst credit scores would be at least 1000.

Credit History Impact On Your Scores Reports Credit Karma

Credit History Impact On Your Scores Reports Credit Karma

Credit scoring is very confusing.

Why is my credit score higher on credit karma. Credit score ranges. There are many different scoring models. Think of your credit scores as a report card that gauges your creditworthiness.

It all depends on the make up of your specific credit profile. Plus credit scores come from different scoring models including FICO and Vantage 30. This is not comparing apples to apples.

Everything on Credit Karma is free if you sign up for its membership. Most people would seriously be stunned if they knew just how many credit scores there are Jacob Passy 222021. Mortgage lenders use a score developed specifically for mortgage loans.

For perspective the card was 66 utilization and total aggregate was 104 utilization I already paid it off. Why your Credit Karma score may be higher than your FICO score. Many of these tweets centered on a common theme that the credit scores Credit Karma INTU -140 presents are higher than what lenders see.

Small changes in these areas can lead to quite different final scores. For this reason VantageScore and FICO Scores tend to vary from one another. There are reports of people with Credit Karma scores over 700 with both bureaus but with FICO scores in the lower 600s.

Your VantageScore 30 on Credit Karma will likely be different from your FICO. That means your credit score based on information from TransUnion might not exactly match the score based on data from Experian. The reason being is a 1000 credit card is much less risk than a 200000 mortgage.

Most banks use FICO scores. Credit utilization provides one example of differentiation particularly as it relates to the treatment of charge cards by many of the older FICO models still in use today according to John Ulzheimer a credit-scoring expert who previously worked for FICO and EquifaxCharge cards are considered by FICO scores but only those. In the case of FICO Scores if you consistently score above 800 its like getting straight As.

Great chance you are comparing a score from Credit Karma with a range of 501-990 versus the score your bank is using with a range of 300-850. The Vantage algorithm being used by Credit Karma is typically 50 points or so higher than a mortgage FICO score Mortgage FICO scores analyze your payment history the number of years youve had credit types of credit accounts you have and more. The higher your score the better.

The majority of lenders use FICO - so while credit karma is great for monitoring and reviewing your reports their scores should be ignored. Credit Karma is a free website that provides credit scores and reports to its members along with financial articles and advice. Normally the discrepancy in scores is minor but according to Investopedia Credit Karma scores which are sourced from VantageScore data provided by two of the major credit bureaus TransUnion and.

Whether its a different score from a bank an auto lender or another source its not unusual to see many different credit scores. Your Credit Karma score could be much lower than your FICO score. It can be surprising to know that there are potentially hundreds of credit scores she says.

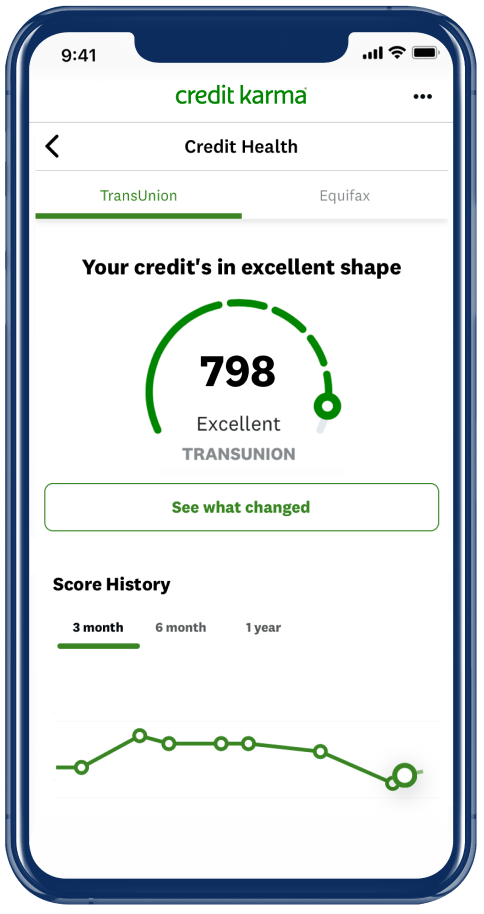

For those who are working to improve their credit scores a tool like Credit Karma can be very useful. However credit scores are. On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model.

These scores are not provided by Credit Karma. For example auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Credit Karma does not provide FICO scores they are of a different scoring model cslled Vantage 3.

Vantage and FICO differ greatly in how they weigh and respond to different aspects of your credit profile. More than 90 of lenders prefer the FICO scoring model but Credit Karma uses the Vantage 30 scoring model. Credit Karmas Hardeman recommends picking one and sticking with it.

Here are three of the reasons why. The mortgage FICO scores are much more. The reason is most credit cards are using a FICO 8 credit score which is typically 60 points or higher than a traditional mortgage FICO.

Just checked Credit Karma and it dropped 67 POINTS. Credit Karma provides free credit monitoring through daily or weekly updates to your. VantageScore was created in collaboration with all three credit.

The most common scores range from 300 points to 850 points. Looks like CK is more balance utilization sensitive. When my balances were all 0 across the board 2-3 weeks ago my Vantage scores all went up while FICO went down.

Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for.