The end is the selected number of minuteshours after Bloomberg Trade Order Management System the start if less than one day in duration or at. Pro Signal Robot is Bloomberg Trading Order Management System a very easy and user friendly binary option signal software.

Ft Bloomberg Professional Services

Ft Bloomberg Professional Services

Bloomberg Trade Order Management Solutions TOMS provides fixed income sell-side firms the capabilities to efficiently manage inventory risk PL compliance and straight-through processing.

Bloomberg order management system. Using our software you can trade with most top 10 currency pairs. For sell-side fixed income firms Bloomberg Trade Order Management Solutions TOMS delivers global multi-asset solutions for front-end inventory trading and middle and back office operations. Bloombergs order management system OMS AIM delivers global multi-asset solutions for portfolio management trading compliance and operations for buy-side firms.

Bloombergs Buy- and Sell-side order execution and position management systems are designed to meet and exceed these needs. Open Source Order Management System using Bloomberg EMSX API Background Philosophy. The start is when the contract is processed by our servers.

Most important AIM BGIN is pre-integrated with the Bloomberg Terminal which the firm had already planned to use for news pricing and analytics. This year the New York data and technology giant has re-established itself as the premier provider of sell-side order management system OMS technology at the Waters Rankings collecting the award for the second year running and for the seventh time overall thanks to its sell-side multi-asset offering Bloomberg Trade Order Management Solutions TOMS which once again stands head and. It also supports regulatory.

This seamless operational infrastructure would enable the firm to handle operations in an integrated fashion and keep productivity high. Automate the complete trade and order management processfrom receipt of client orders to post-trade analysis of execution to regulatory reporting OATS and TRFACT Manage facilitation agency and principal trading market making pre-trade checks execution errors handling and regulatory reporting. AIM is used by more than 13000 professionals in nearly 90 countries at over 800 client firms including some of the largest asset managers hedge funds insurance companies pension funds and government agencies.

EURUSD GBPUSD USDJPY EURGBP AUDUSD USDCAD USDCHF NZDUSD EURJPY EURAUD and 5 different expiry. The contract period is the period between the next tick after Bloomberg Trade Order Management System the start and the end. Bloomberg has dominated an analysis of order management systems OMS and execution management systems EMS used by asset managers who spent 14 billion on deploying such systems in 2018.

It is based on an advanced and very sophisticated algorithm that allows to generate unlimited binary option Bloomberg Trading Order Management System signals in Bloomberg Trading Order Management System a few clicks without trading experience. Bloomberg Trade Order Management System generate unlimited binary option signals in a few clicks without Bloomberg Trade Order Management System trading experience. The BLOOMBERG TERMINAL service and data products BLOOMBERG Data and BLOOMBERG Order Management Systems the Services are owned and distributed by Bloomberg Finance LP.

Risk management as well as order and execution management. With the Gateway TOMS provides global middleware and data management solutions to increase operational efficiency and lower implementation costs. TOMS delivers global multi-asset solutions for.

Get the power to do more with a single trade order management system. Bloomberg trade order management system 04 05 TOMS provides a full range of solutions for managing market credit and counterparty risk. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and.

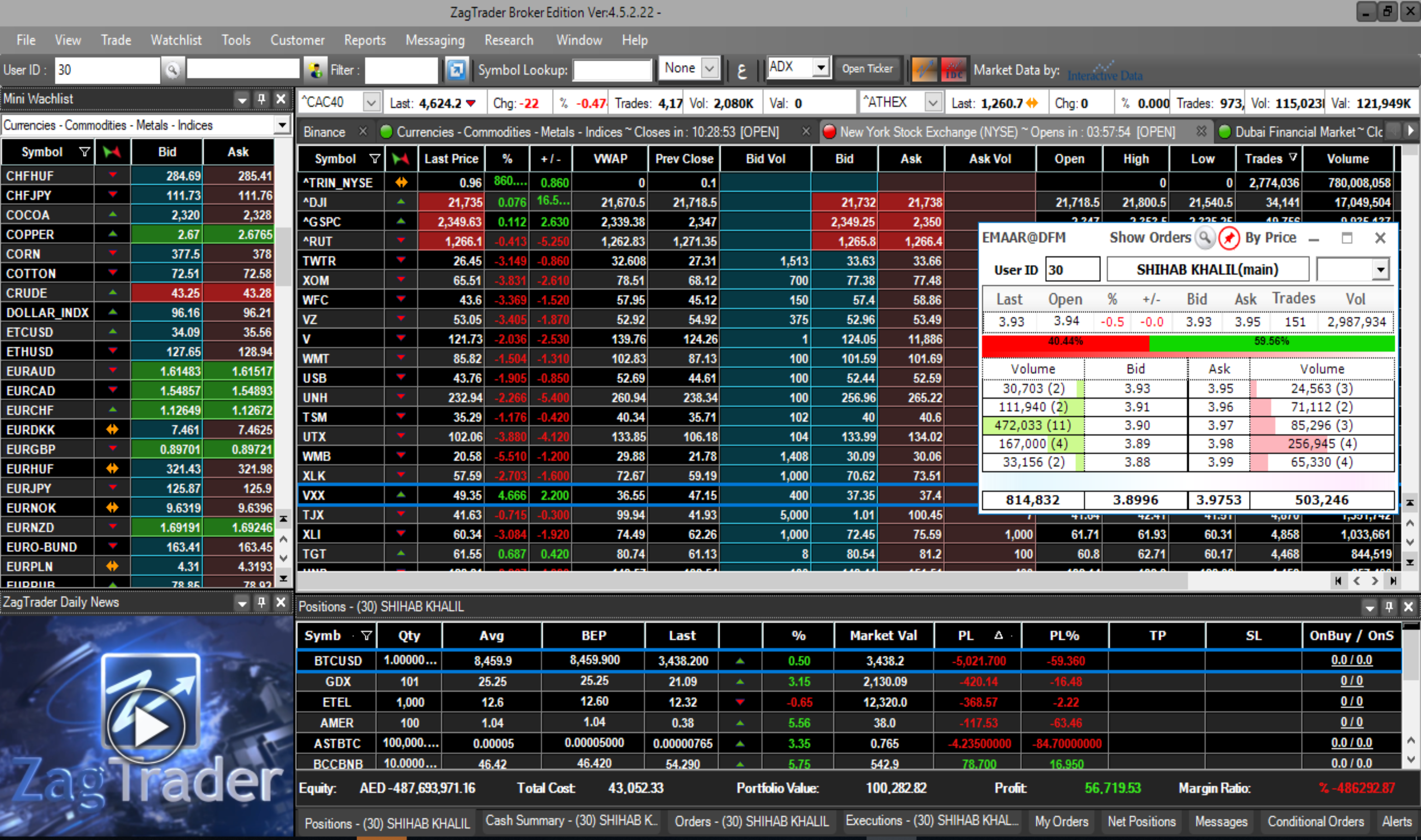

Bloomberg Sell-Side Execution and Order Management Solutions SSEOMS deliver global order and execution management solutions for front-end sales and trading and middle and back office operations. Asset Managers want more time to focus on making money and less time on Technology and Fund Administration. Thousands of traders and salespeople across the globe rely on the renowned Bloomberg TOMS Trade Order Management System to run their business.

The T1 Multi Asset System solves for this. Bloomberg Trade Order Management Solutions visits the NYSE to mark the launch of an integrated platform for sell-side fixed income dealers to access the US. SSEOMS offers an integrated suite of solutions including.

Idea generation liquidity management and electronic order flow.