At Fidelity you can change your account registration online once the minor has turned 18 or reached the age of majority. Custodial accounts are accounts for minors generally those less than 18 years old set up by parents guardians and other adults.

How To Sign Up For A Fidelity Brokerage Account A Step By Step Guide Nasdaq

How To Sign Up For A Fidelity Brokerage Account A Step By Step Guide Nasdaq

At age 18 your teens account will be transitioned to a retail brokerage account for free.

Fidelity brokerage account for minors. At most brokers the entire process is. The fund manager will. Identifying information Social Security number date of birth etc Contact information legalmailing address email address phone number Employment information if applicable occupation employers name and address Identifying information for.

Parentsguardians who currently have a Fidelity account can open this account with their 13 to 17 year old. If they are a. Here youll find the link to open the custodial account.

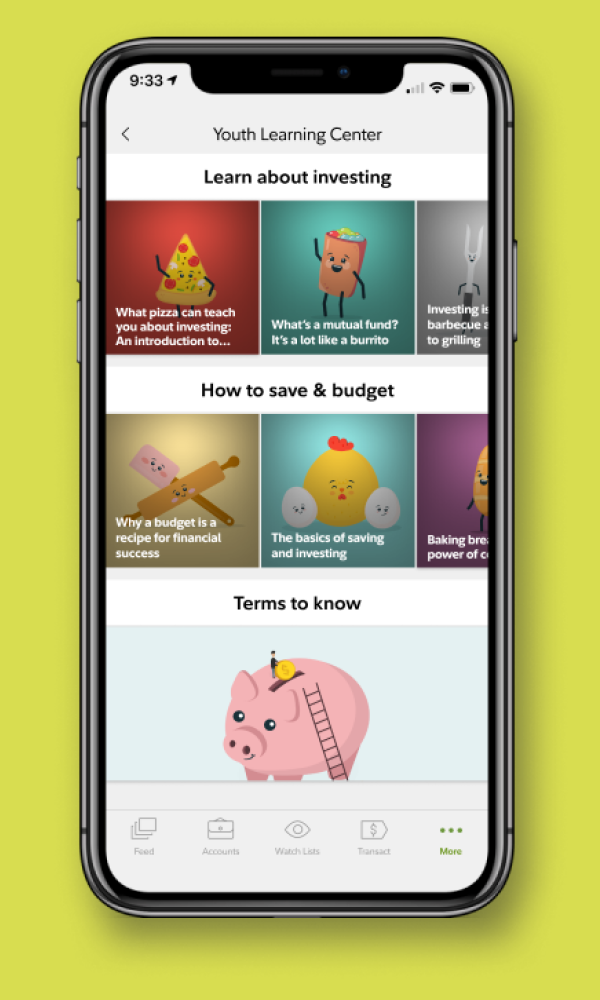

It can be a great way to save on the childs behalf or to give a financial gift. The money in this account belongs to the child. Fidelity said Tuesday it will issue debit cards and offer investing and savings accounts to 13- to 17-year-olds whose parents or guardians also invest with the firm.

If you already have a Fidelity account you can log in and have some details pre-filled. 16 Zeilen The account owner is the eligible individual or designated beneficiary. To open an account.

Fidelity Investments is giving teenagers access to financial markets with a new type of brokerage account. A custodial account is a financial account held in the name of a minor usually by a parent legal guardian or another relative. If you are a parent or guardian of a young person this gives you the opportunity to save and invest for your child while retaining.

Fidelity Investments is expanding its no-fee investing accounts to a new group. Minors may not be able to open their own brokerage accounts but family and friends can help them set up custodial or guardian accounts and when a. You can open a custodial account both a standard brokerage account and a Roth IRA for your child in under 15 minutes or so.

Custodial accounts are necessary because they are the only way for minors to enter into any financial transactions such as opening bank accounts or stock trading accounts. The fund manager will provide investing and savings accounts and debit cards to 13-. With parental permission and guidance of course.

Bloomberg Fidelity Investments is giving teenagers access to financial markets with a new type of brokerage account. Of course custodial accounts are not the only way to manage money for a childa trust could also be established which may allow for more control over when the beneficiary can access the money and how it can be used. If you need any help during the account opening process feel free to give Fidelity a call at 800-343-3548.

Theres one catch to use a minor Roth IRA your child must have earned income and you can only contribute as much as they earn in the year up to the annual maximum which is. With a custodial brokerage account you dont own the money -- your child does. Simply Google start a Fidelity brokerage account and youll find a link to the firms website where you can see the different account types he says.

A Fidelity custodial account sometimes called a UTMAUGMA account is a brokerage account for investing in stocks bonds mutual funds and more. Parents can monitor account activity online and through monthly statements trade confirmations and by viewing debit card transactions. The investing firm Tuesday announced the Fidelity.

As long as your child is a minor you control the account but any withdrawals or dividends can be taxed to your. From there you click which account you. Youll need details on the minor and the adult opening the account.

Fidelity Investments announced Tuesday that its launching a new investment account -- dubbed the Fidelity Youth Account -- for teens aged 13 to 17 who want to start trading.

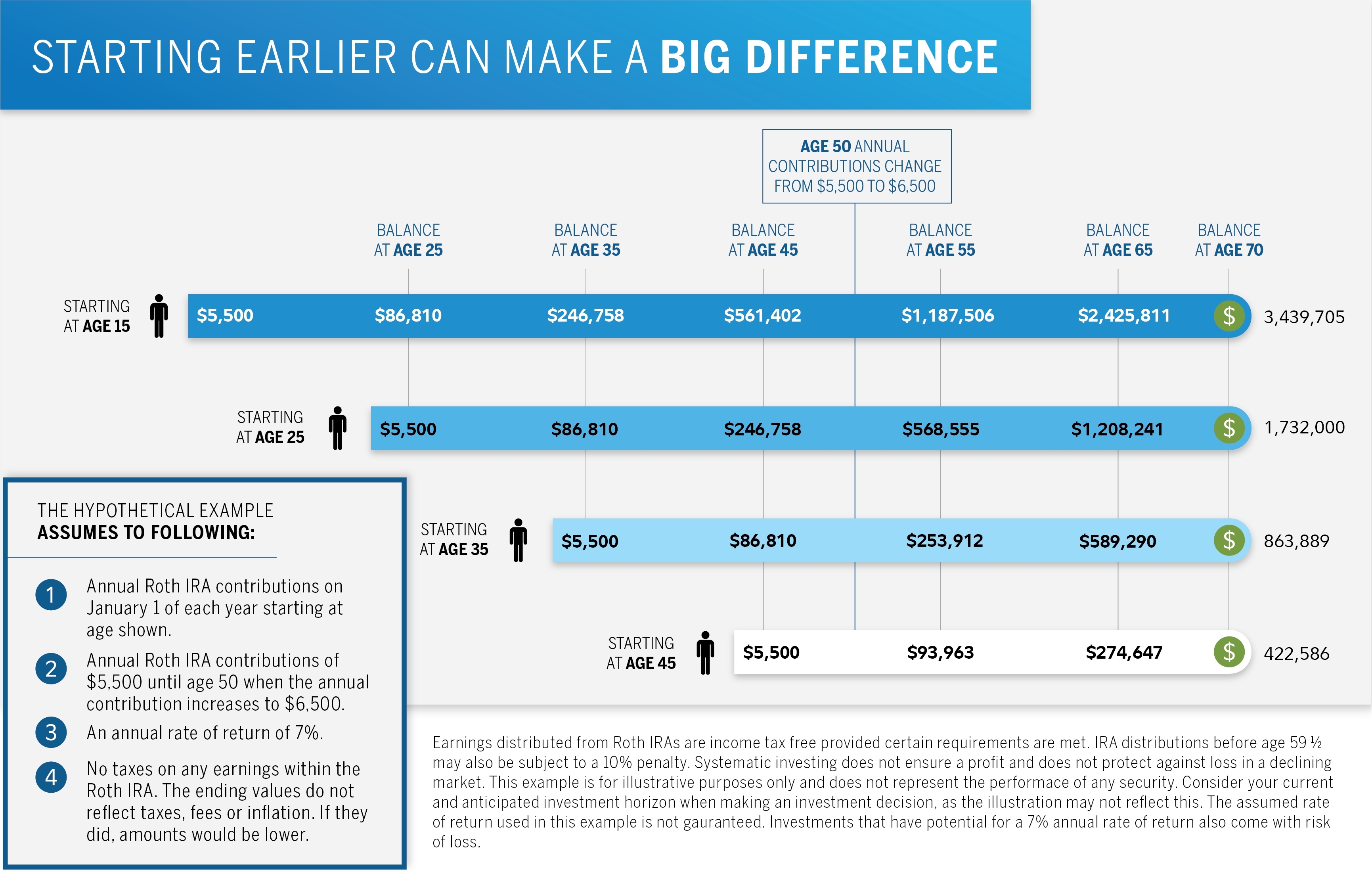

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Can Minor Open Brokerage Account Fidelity Vs Td Ameritrade Platform Alianza Portones

Can Minor Open Brokerage Account Fidelity Vs Td Ameritrade Platform Alianza Portones

Ugma Utma Accounts Tips For Custodial Accounts Fidelity

Ugma Utma Accounts Tips For Custodial Accounts Fidelity

2021 Fidelity Investments Review Fees Pros And Cons Benzinga

2021 Fidelity Investments Review Fees Pros And Cons Benzinga

Fidelity Custodial Account Ugma Utma Minor Investing 2021

Fidelity Custodial Account Ugma Utma Minor Investing 2021

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Active Trader Pro Pc Laptop System Requirements 2021

Fidelity Active Trader Pro Pc Laptop System Requirements 2021

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

Fidelity S Roth Ira For Kids Sees Strong Growth As Parents Prioritize Giving The Next Generation A Head Start On Retirement Business Wire

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.