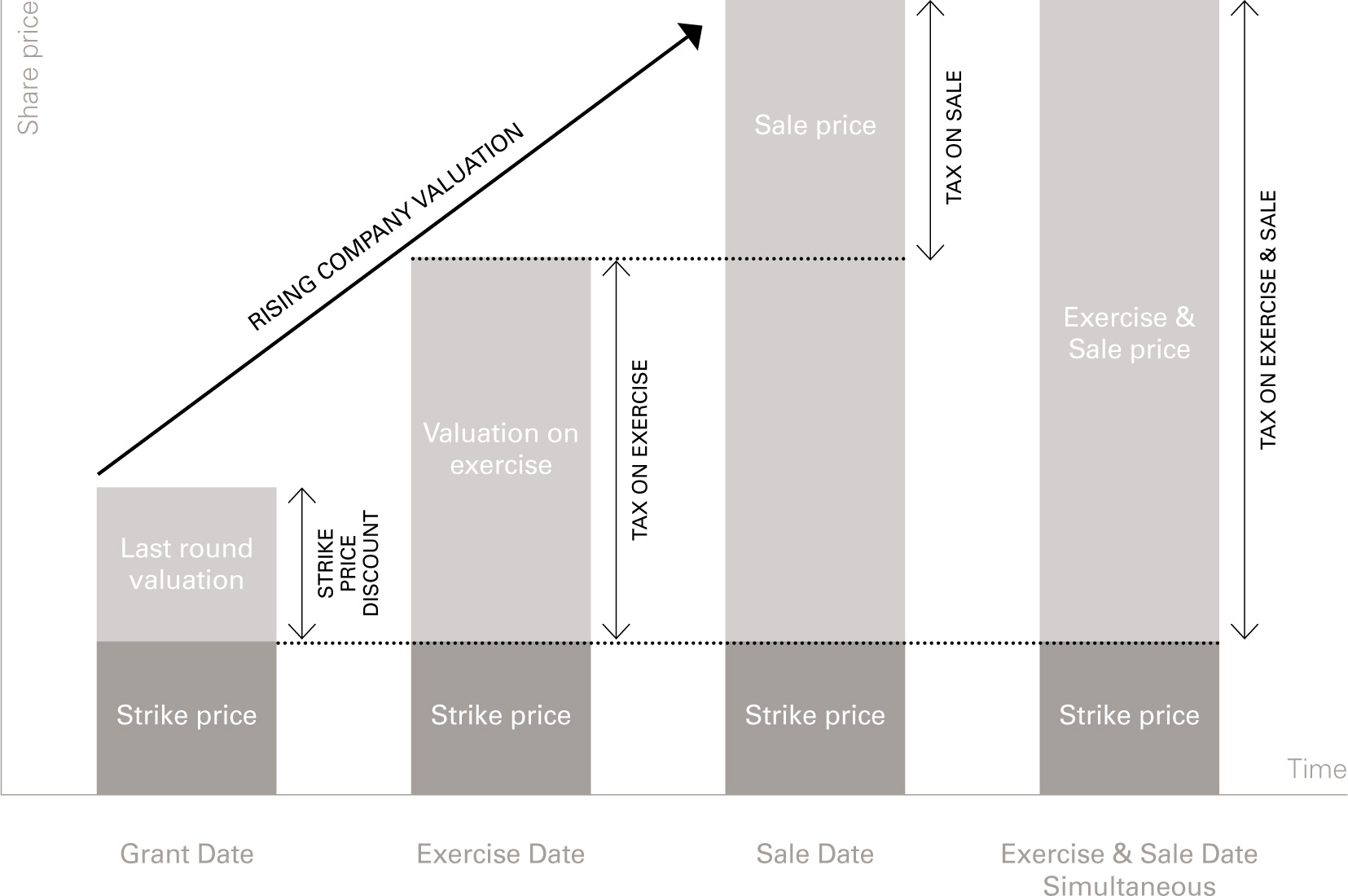

If Mary gets a stock option when the strike price is 1 and the price goes up to 10 she participates in the 9 gain. Oil prices jumped 22 to 7251 per barrel.

Preparing An Employee Stock Option Plan Esop In Singapore Singaporelegaladvice Com

Preparing An Employee Stock Option Plan Esop In Singapore Singaporelegaladvice Com

42 Zeilen View the basic UPS option chain and compare options of United Parcel Service Inc.

Ups stock options for employees. Employees that leave before the vesting period ends forfeit any unvested stock back to the option pool. Building stock options into compensation packages can be a win-win because it aligns employees with management and the board of directors. UPS offers an employee discounted stock purchase plan.

These would usually be for restricted stock or stock options with a standard 4-year vesting schedule. A Stock Option Plan gives a company the flexibility to award stock options to employees officers directors advisors and consultants allowing these people to buy stock in the company when they exercise the option. Glassdoor is your resource for information about the Stock Options benefits at UPS.

In our experience there is no one-size-fits-all solution when it comes to assigning employee stock options. They are awarded by. Anzeige Buy Sell Share CFDs From Your Home.

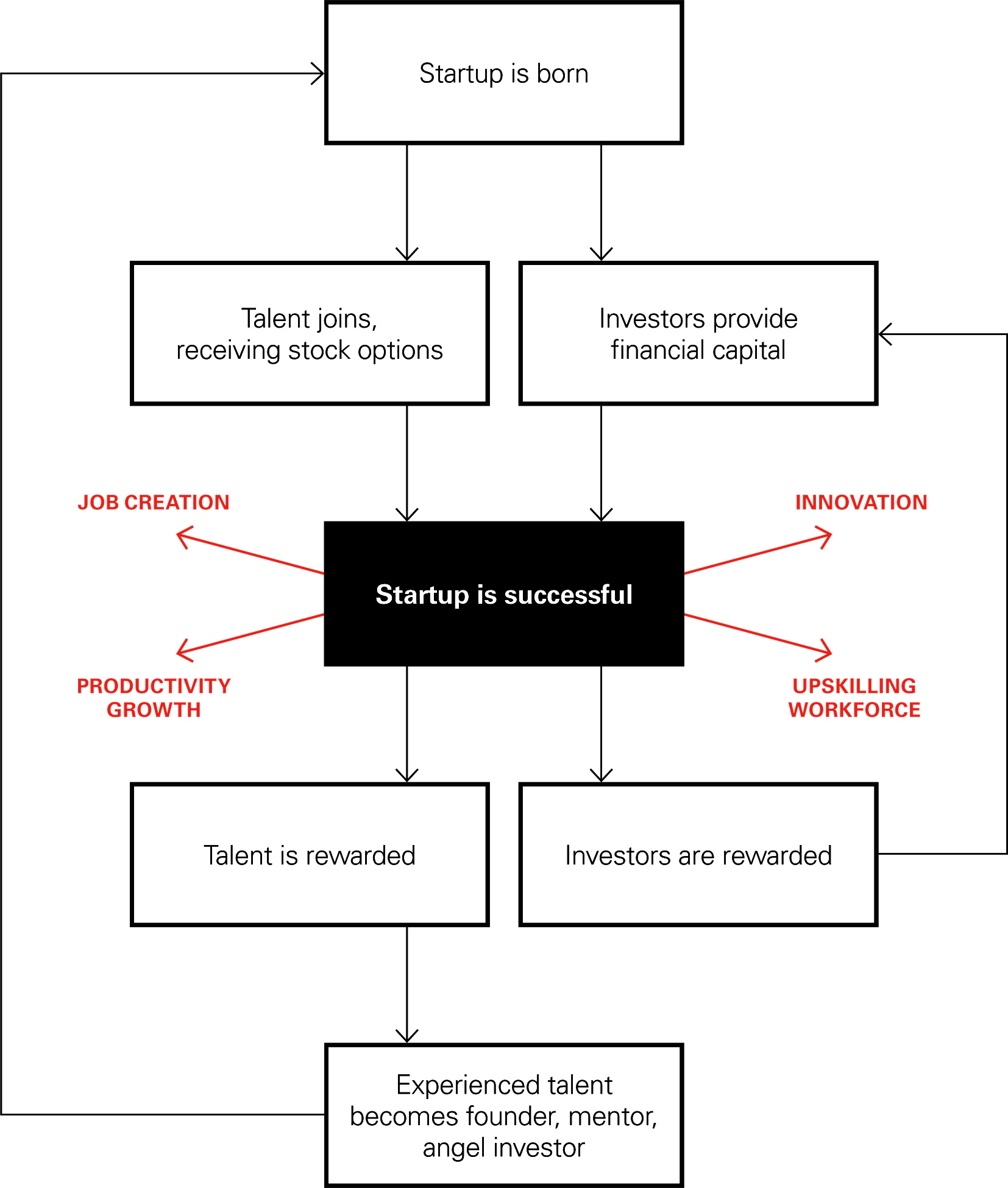

A stock grant is simply an amount of stocks an employer grants to the employee as a form of compensation. Hires you congrats. However there is also the case of rewarding early employees with stock options.

At the time its granted a set of stock options represents some portion of the companys overall ownership. Participants showed continued favor for commodities which helped the CRB Commodity Index advance 18 as gold prices settled 14 higher at 102020 per ounce and silver prices climbed 25 to a new 12-month high of 1743 per ounce. Your Capital is at Risk.

Stock Grants are especially good offering especially for a startup employee for three reasons. Work with us stick with us and if we make it big youll make money too. Stock options are great because employees participate in the upside without taking on any downside riskJames Seely head of Marketing at the ownership management platform Carta tells Startupsco.

In fact Stock Option Plans can actually contribute capital to a company as employees. As part of your hiring package Venture Startup Inc. Stock Option Plans permit employees to share in a companys success without requiring a startup business to spend precious cash.

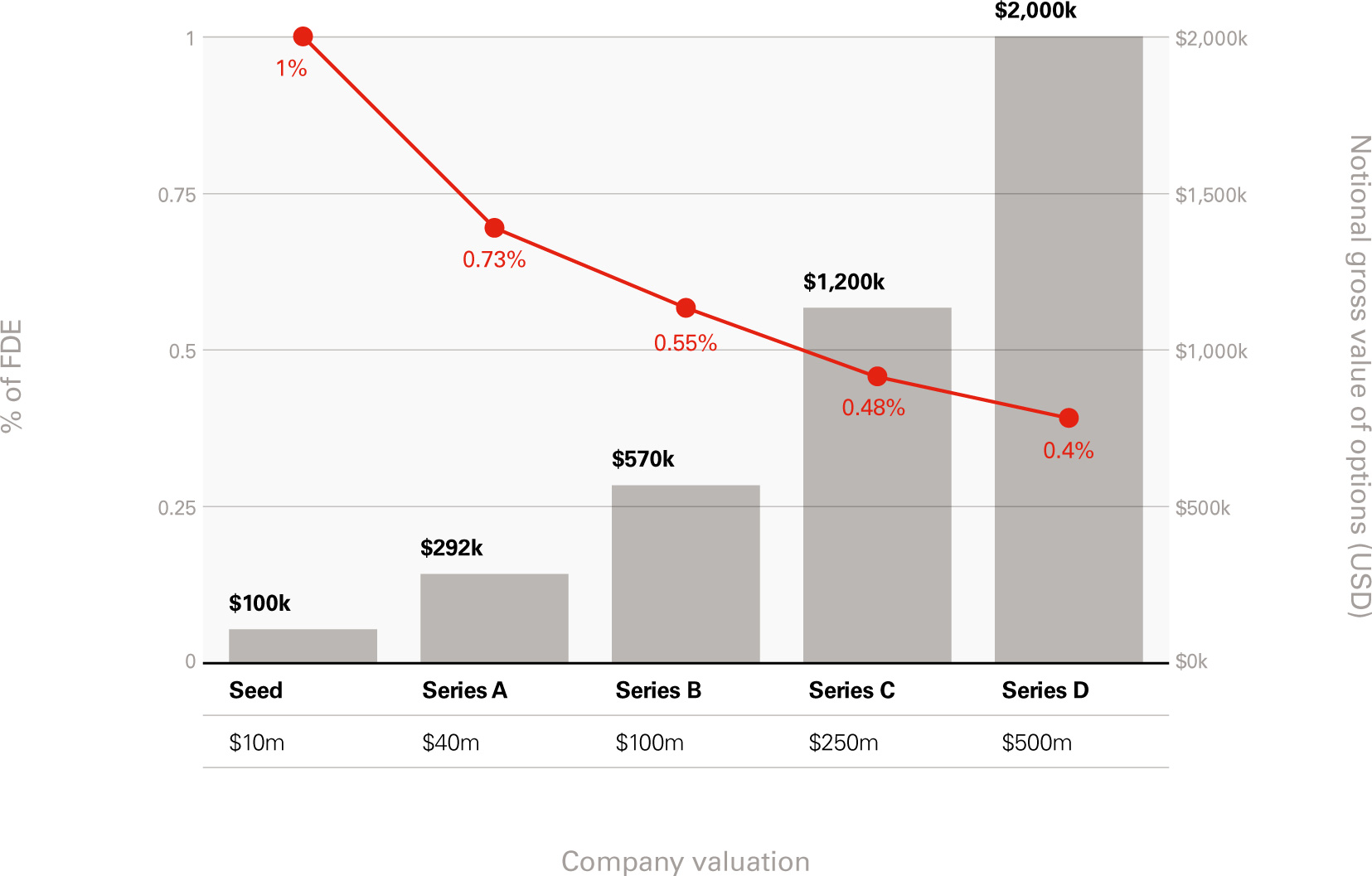

Each month through the 4th year 148th of that employees options will vest. In our previous post about how much equity to offer to investors at different funding rounds we looked at the equity boundaries that a founder can offer at the different stages of development of a startup. Has a Stock Option Plan that grants you options to acquire 10000 shares of Venture Startup.

For one early-stage startups often only share out a small amount of stocks. Learn about UPS Stock Options including a description from the employer and comments and ratings provided anonymously by current and former UPS employees. Employer Verified Available to US-based employees Change location.

Your Capital is at Risk. The best use of stock options in a startup mode is as a message. The people who get the options should realize that these are very long odds but there is a message from founders to employees.

In fact Stock Option Plans can actually contribute capital to. They apply if each of these roles were filled just after an A round and the new hires are also being paid a salary so are not founders or employees hired before the A round. The employee buys 40k in stock options with a strike price of 375 10667 options 375option As in every complex issue there are always assumptions to.

The 4-year monthly vest thereafter means that the employee will earn the remaining 75 from day 366 through the 4th year on a monthly basis. Thus a single stockholder owns a larger share of the company. Venture Startup Inc.

Anzeige Buy Sell Share CFDs From Your Home. Stock options given to employees come out of the startups option pool which is set aside usually at the companys founding and after a funding event representing 10-20 of total company ownership. Option grants for employees Stock options represent the right to purchase a specified number of shares of Common Stock at a specific price representing the market value of the companys stock at the time of grant regardless of whatever the market value of the stock will be in the future when the options are exercised.

Empowering your employees with. Stock Option Plans permit employees to share in the companys success without requiring a startup business to spend precious cash. Stock options are a benefit often associated with startup companies which may issue them in order to reward early employees when and if the company goes public.

Employee Stock Option Plan For An Unlisted Company

Employee Stock Option Plan For An Unlisted Company

Employee Stock Option And Phantom Share Plans Pool Size Vesting Schedule Examples Ledgy

Employee Stock Option And Phantom Share Plans Pool Size Vesting Schedule Examples Ledgy

Equity 101 Stock Options Explained For Startup Employees Carta

Equity 101 Stock Options Explained For Startup Employees Carta

What Type Of Equity To Give Startup Employees Tyson Law

What Type Of Equity To Give Startup Employees Tyson Law

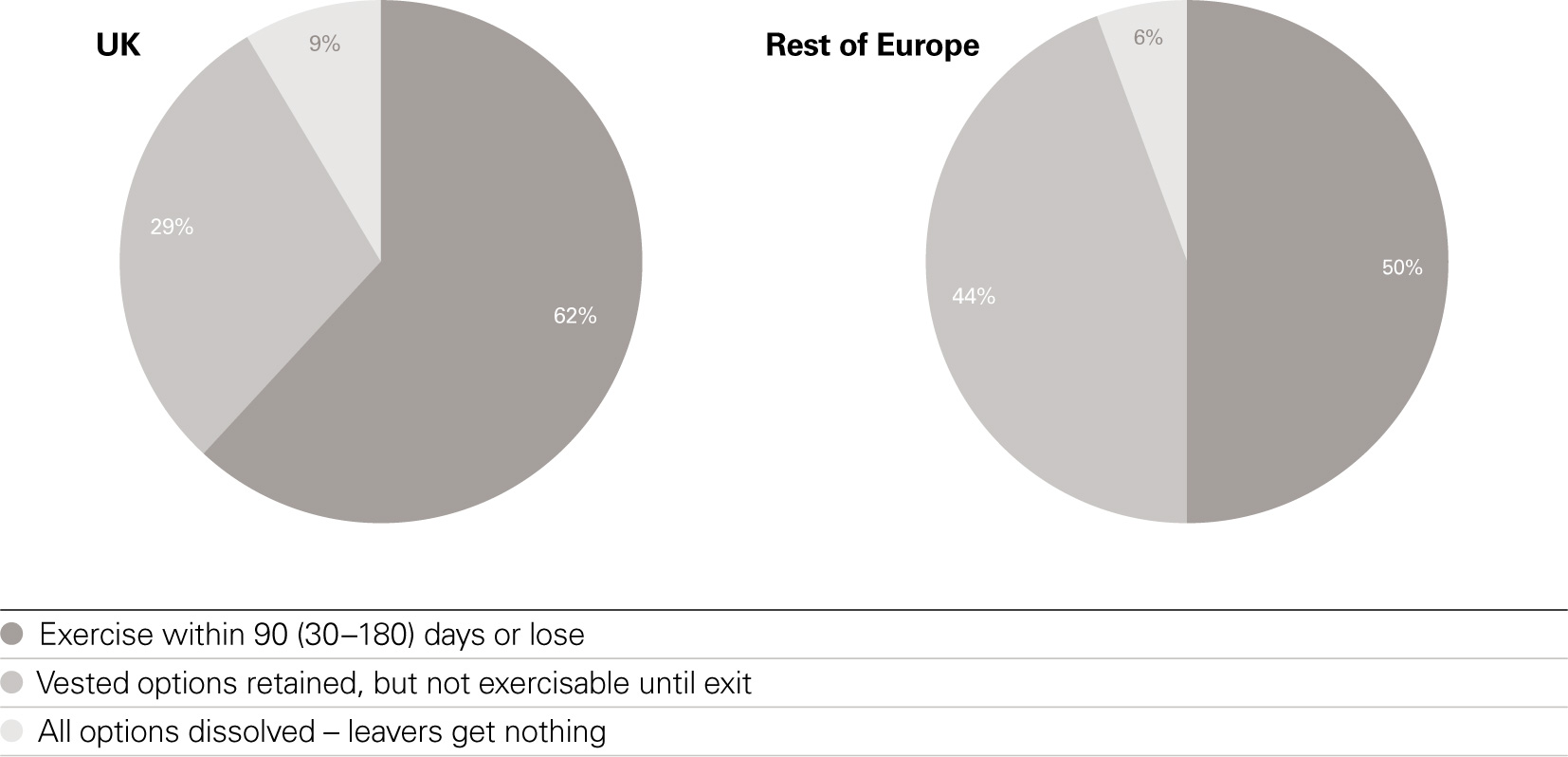

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

Rewarding Talent Index Ventures

Rewarding Talent Index Ventures

Employee Share Scheme What You Need To Know Docpro

Employee Share Scheme What You Need To Know Docpro

Stock Options Why It S Time For Startups To Replace Them By Sam Jadallah Medium

Stock Options Why It S Time For Startups To Replace Them By Sam Jadallah Medium

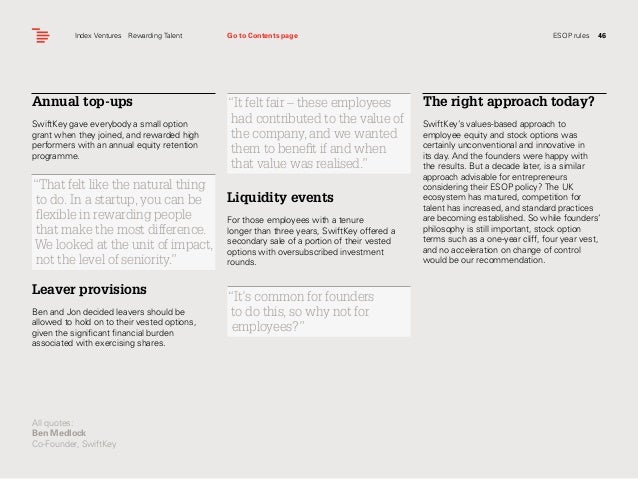

Rewarding Talent Index Ventures

Rewarding Talent Index Ventures

Startup Employee Equity 101 How To Give Equity To Your Team The Hub Blog

Startup Employee Equity 101 How To Give Equity To Your Team The Hub Blog

Employee Stock Option Plan For An Unlisted Company Neeraj Bhagat Co

Employee Stock Option Plan For An Unlisted Company Neeraj Bhagat Co

Employee Stock Options What You Need To Know

Employee Stock Options What You Need To Know

Rewarding Talent Index Ventures

Rewarding Talent Index Ventures

Rewarding Talent A Guide To Stock Options For European Entrepreneurs

Rewarding Talent A Guide To Stock Options For European Entrepreneurs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.