All other persons must obtain a Missouri Power of Attorney Form 2827. 59B Articles of Dissolution by Voluntary Action Corp.

What Are The Seller Closing Costs In Missouri Houzeo Blog

What Are The Seller Closing Costs In Missouri Houzeo Blog

To close the deal all you have to do is prepare process the paperwork and of course sign them.

Closing a business in missouri. To make changes to your existing Missouri Department of Revenue business tax account please complete Registration Change Request Form 126 and mail to Missouri Department of Revenue PO Box 3300 Jefferson City Mo 65105 or email it to businesstaxregisterdormogov. Open the following new business location for. How do I make changes to or close my business tax account.

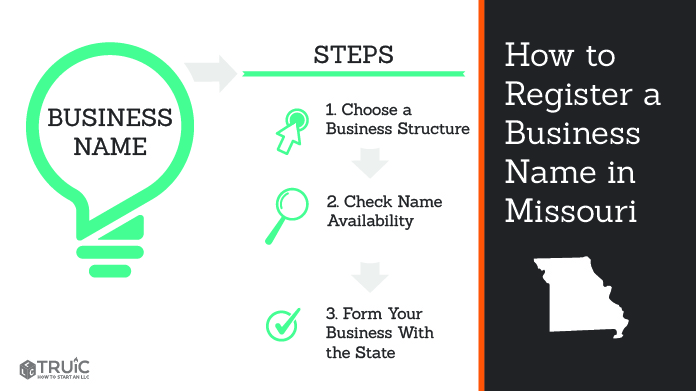

Restrictions on Missouri Business Name Business Purpose Any individual or entity that conducts business under a name other than its actual name should register that fictitious name. The information also may be provided online through UInteract. R Consumers Use Tax r Employer Withholding Tax r Sales Tax r Vendors Use Tax Business Name Taxable Sales Begin Date MMDDYYYY Street or Highway Address Do not use Rural Route or PO Box.

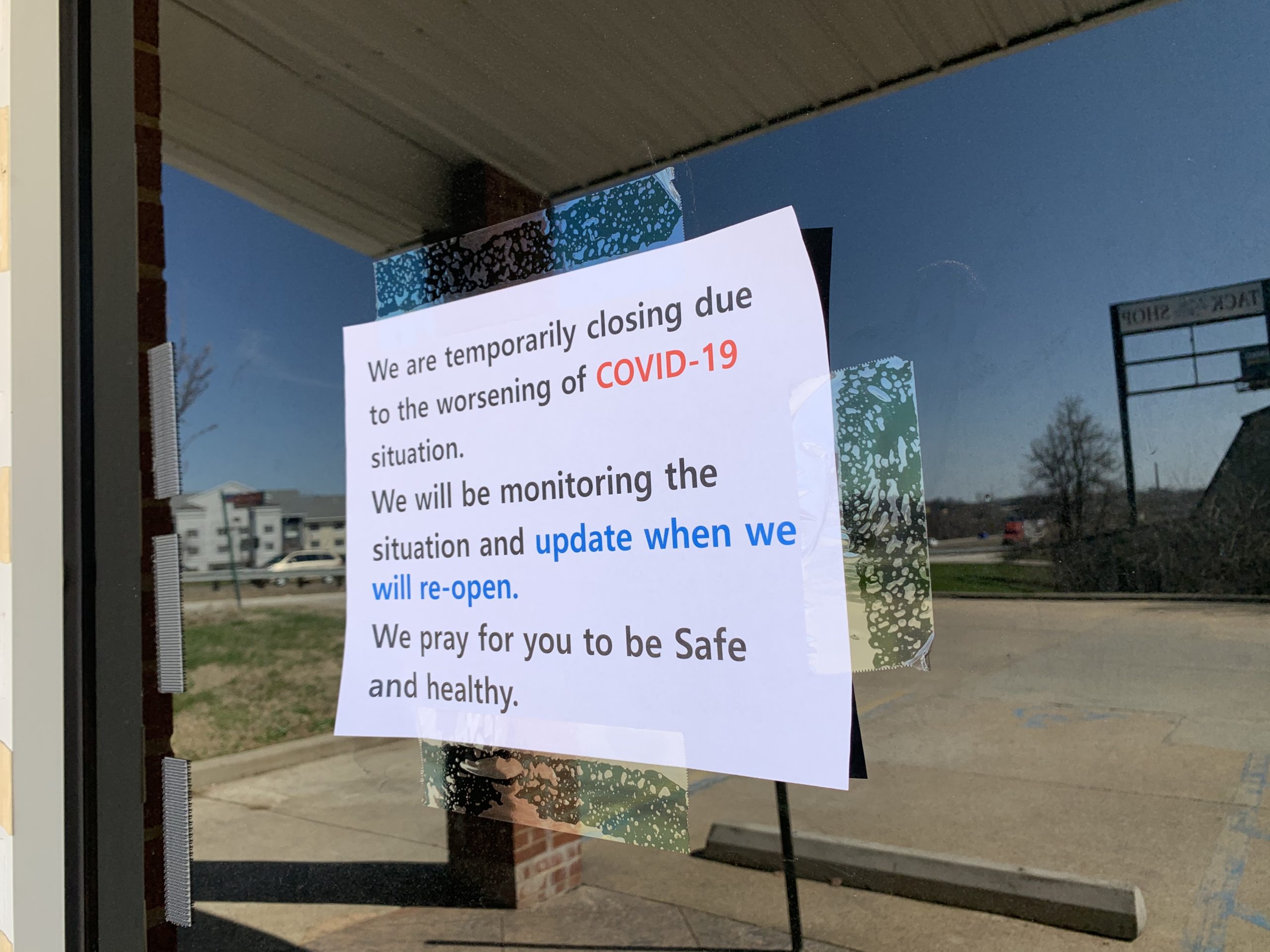

Then once you wind up your LLC you must file the Articles of Termination. Every business shall abide by social distancing requirements including maintain six feet of space between individuals. 60 Statement of Change of Registered Agent or Registered Office Corp.

Sole proprietors can decide on their own but any type of partnership requires the co-owners to agree. You must file a final return for the year you close your business. Statement of Correction for a General Business or Nonprofit Corporation Corp.

Beyond the emotional toll you will want to ensure that you remain compliant with legal guidelines throughout the process of closing down a business. However it can also be the most rewarding experience youll have If you armed with knowledge and tips. Its also helpful to seek advice from your lawyer and a business evaluation expert along with other business professionals including accountants bankers and the IRS.

Attach a list if needed. Individuals performing job duties that require contact with people closer than six feet should take enhanced precautionary measures to mitigate the risks of contracting. The use of certain words and phrases in corporate names is.

Businesses conducting going-out-of-business sales must register the sale with the Attorney Generals Office at least 10 days before it begins. Follow your articles of organization and document with a written agreement. A limited liability company LLC is a business organized under state law.

59 Statement of Change of Business Office of a Registered Agent Corp. If youve registered a Missouri Corporation with the Missouri Secretary of State and want to cease business activities you have to let the MO Secretary of State know that you intend to close your company. A business may change ownership due to a sale lease reorganization merger foreclosure or inheritance.

This short course reviews the actions and notifications that are needed within the business as well as those for local state and federal agencies and departments. More often than not closing a Missouri property can be a stressful process. If the time comes for whatever reason to close a business it requires more than just locking the doors and walking away.

Only after the MO Secretary of State has made sure that all of the obligations of the Missouri LLC have been fulfilled will the Secretary of State approve of the closure of the company. Letting people go is one of the hardest parts of the process. Both forms are 25.

If you have diverted funds away from payroll before you close they may be able to make a claim against you and your. If youve registered a Missouri LLC with the Missouri Secretary of State and want to cease business activities you have to let the MO Secretary of State know that you intend to close your company. In Missouri you must first file a Notice of Winding Up to inform the state that you are in the process of ending your business.

The type of return you file and related forms you need will depend on the type of business you have. Follow these steps to closing your business. An employer should inform the Division of Employment Security DES when a change in ownership of business occurs by completing the Employer Change Request.

Missouri requires business owners to submit their Articles of Termination by mail or online. This state law Section 407800 also applies to any advertising using language that indicates a store is closing such as liquidation sale. Only after the MO Secretary of State has made sure that all of the obligations of the Missouri Corporation have been fulfilled will the Secretary of State approve of the closure of the company.

59A Statement of Resignation of Registered Agent Corp. There are no prerequisite knowledge and competencies. Pay people until you close your business.

A change of ownership also may occur when the business.

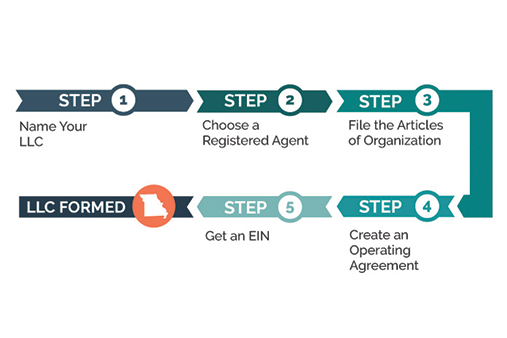

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

Home And Business Closing Process Mid Missouri

Home And Business Closing Process Mid Missouri

Small Business Loan Program Department Of Economic Development

Small Business Loan Program Department Of Economic Development

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

Missouri Unemployment Claims Skyrocket During Coronavirus Pandemic

Missouri Unemployment Claims Skyrocket During Coronavirus Pandemic

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

How To Dissolve An Llc In Missouri How To Start An Llc

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.