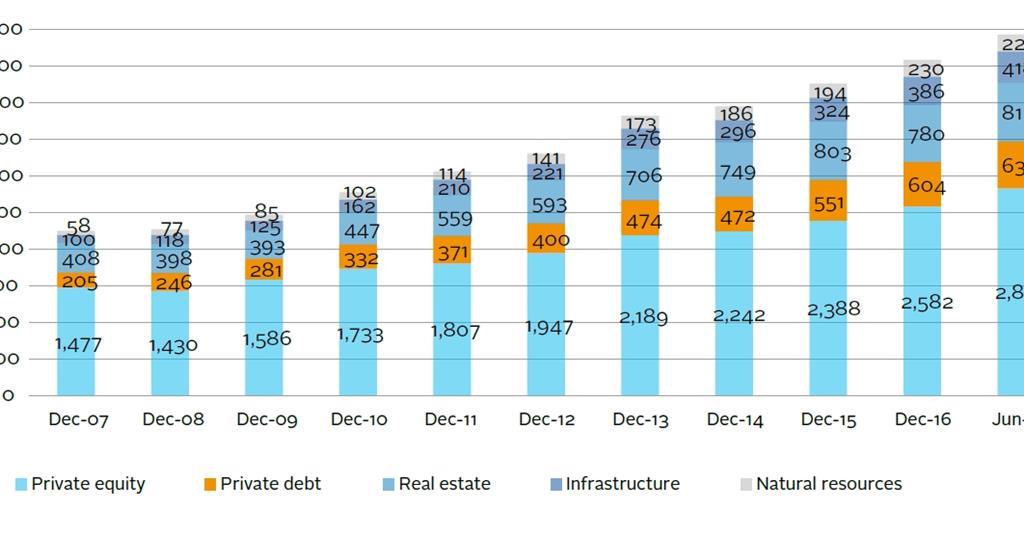

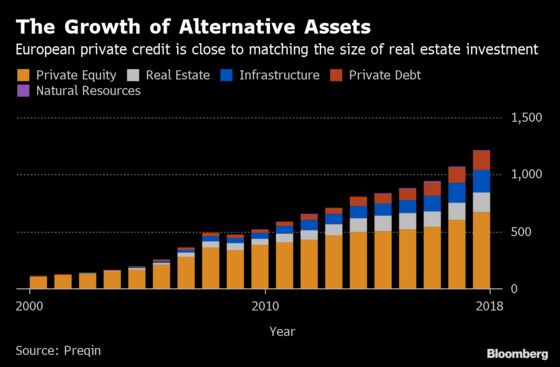

Within this tide of capital one trend stands out. At June 2019 it was estimated to be a US800 billion market and on track to achieve a market size of US1 trillion in the not too distant future.

As at January 2018 there are 335 private debt funds in market seeking 149bn across all private credit strategies including one 10bn vehicle from Goldman Sachs.

Private debt market size. Finally in 2012 the Decreto Legge DL. In fact back in 2000 the private debt market was merely US43 billion. Some large investors that had previously.

Private asset managers raised a record sum of nearly 750 billion globally extending a cycle that began eight years ago. MSCI REAL ESTATE MARKET SIZE 201920 REPORT 5 Market size estimate change Longer term changes in market size weights The size of the professionally managed global real estate investment market increased by 78 from 89 trillion in 2018 to 96 trillion in 2019. The largest funds in the market globally are managed by Cerberus Capital Management LP TCI Real Estate Partners Bridge Investment Group Torchlight Investors LLC and Walton Street Capital LLC.

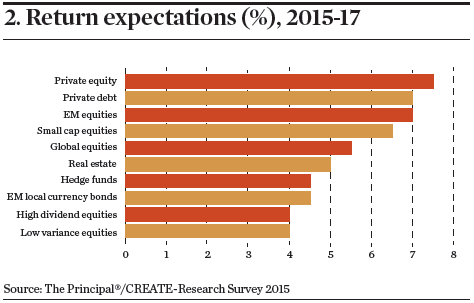

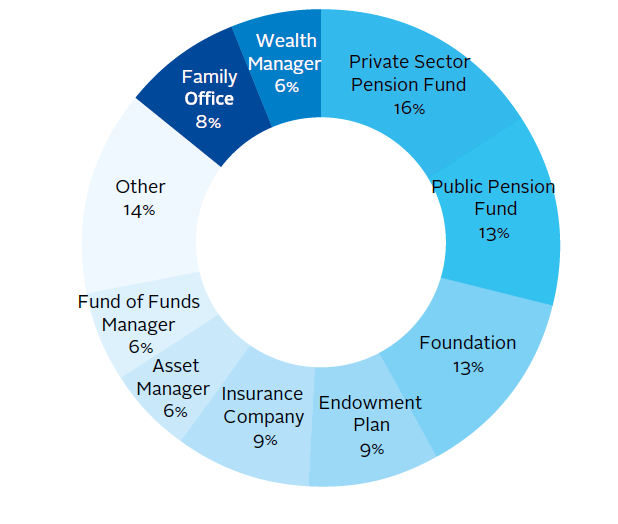

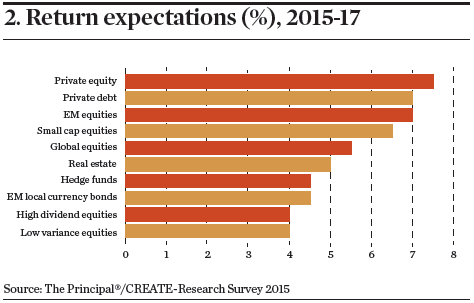

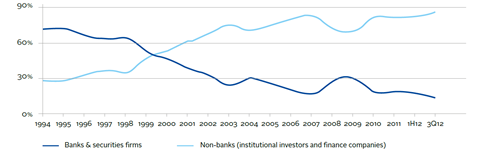

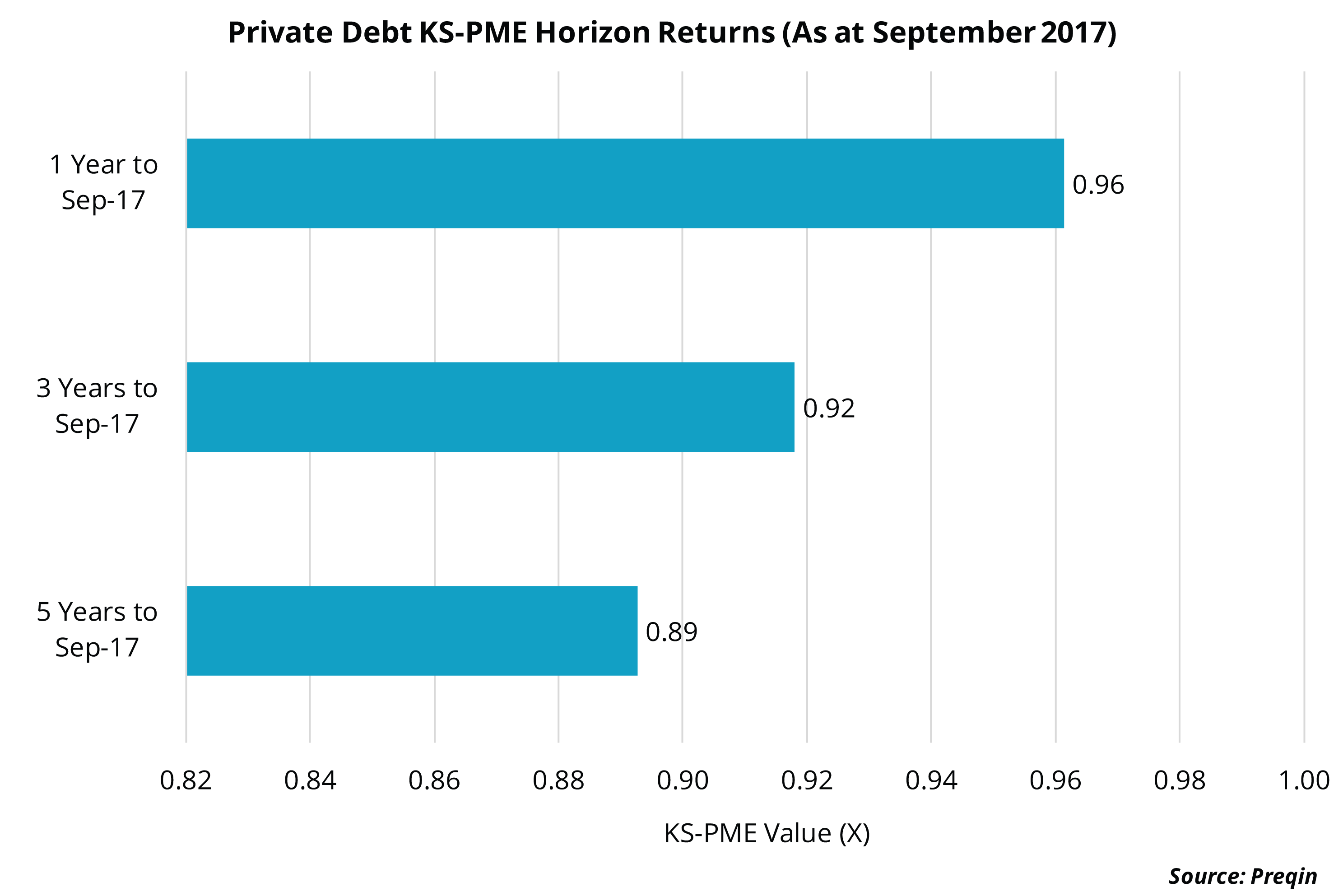

Growth drivers in private debt markets. Stayed away are now allocating to private markets. The benefits of private debt extend beyond higher risk-adjusted returns.

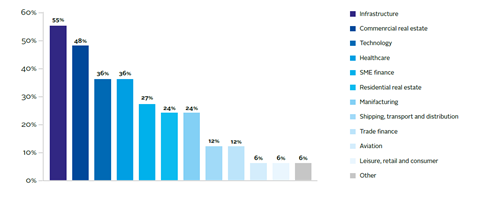

Private Debt Investor tracks the investment appetite and holds the contact details of over 4000 LPs and GPs within our private debt data platform helping to bring together fund investors and managers with matching interests. Asia-focused funds accounted for 9 of all private debt funds closed in 2017 three-percentage points. 51 Preferred loan amount.

The surge of megafunds of more than 5 billion especially in the United States and particularly in buyouts. 8000 a 106 percent increase. Private debt fundraising with 15 funds reaching a final close raising an aggregate 64bn in capital.

In 2015 the European private debt funds managed to raise 41 billion euros. Antares typically provides senior debt junior capital senior secured loans second lien debt mezzanine debt and structured equity. This is the second highest amount of capital raised targeting the region to date and resulted in an average fund size of 427mn.

The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said. Publicly traded firms fell by 16 percent from. 832012 made private debt investments a source of alternative funding.

By 2017 that figure rose to about. The SMEs network is the backbone of Italian economy most of these firms are export oriented and an excellent opportunity for a private debt fund. The growth was higher as compared to 2018 when the market grew by 41.

And confidence in private markets. Also included is comprehensive intelligence relating to funds being raised worldwide with key information on target sizes. Total industry dry powder available as at June 2018 a record level.

5100 to 4300 and by 46 percent since 1996. Its private debt offering is focused on privately negotiated senior loans to middle market businesses with EBITDA between 10m and 75m. The first half of 2017 alone recorded a further 71bn in capital being returned raising the prospect of the industry distributing more than 100bn through the year for the first time.

These debt instruments and funds can play a variety of roles in an institutional investors portfolio and act as a good diversification tool due to historical low correlation benefits. Debt loans in 1Q 2019. Its three main strategies include performing credit credit opportunities special situations and private debt.

Of surveyed fund managers named rising. Marking a decade of significant growth total global private credit AUM had grown to US7675 billion by the end of 2018 according to the definitive 2019 report on private credit from the ACC and Dechert. Average size of private debt funds closed in 2018.

The private-debt industry has grown to almost 770 billion in assets under management as of June from 275 billion in 2009 according to a report. Of surveyed investors expect to invest more capital in private debt in the next 12 months compared with the previous 12 months 307bn.

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

Private Real Estate Debt The Pandemic S Impact And The Industry S Future

Private Real Estate Debt The Pandemic S Impact And The Industry S Future

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

The Heisenberg Report Blog Private Parts Explosion In Private Debt Market Cements Liquidity As The New Leverage Talkmarkets Page 2

The Heisenberg Report Blog Private Parts Explosion In Private Debt Market Cements Liquidity As The New Leverage Talkmarkets Page 2

Private Debt Comes Of Age With Emerging Secondaries Market

Private Debt Comes Of Age With Emerging Secondaries Market

Private Markets Diversifying For The Future Campden Fb

Private Markets Diversifying For The Future Campden Fb

Bluebay Swept Up By Wave Of Divorces In Private Debt Market

Bluebay Swept Up By Wave Of Divorces In Private Debt Market

Research The Rise Of Private Debt Features Ipe

Research The Rise Of Private Debt Features Ipe

How Private Credit Soared To Fuel Private Equity Boom Bloomberg

How Private Credit Soared To Fuel Private Equity Boom Bloomberg

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

Private Debt Vs Public Market Performance Preqin

Private Debt Vs Public Market Performance Preqin

Private Debt Intelligence 2 12 2018 The Lead Left

Private Debt Intelligence 2 12 2018 The Lead Left

Payment Problems Rise In Fast Growing Private Debt Market Wsj

Payment Problems Rise In Fast Growing Private Debt Market Wsj

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.